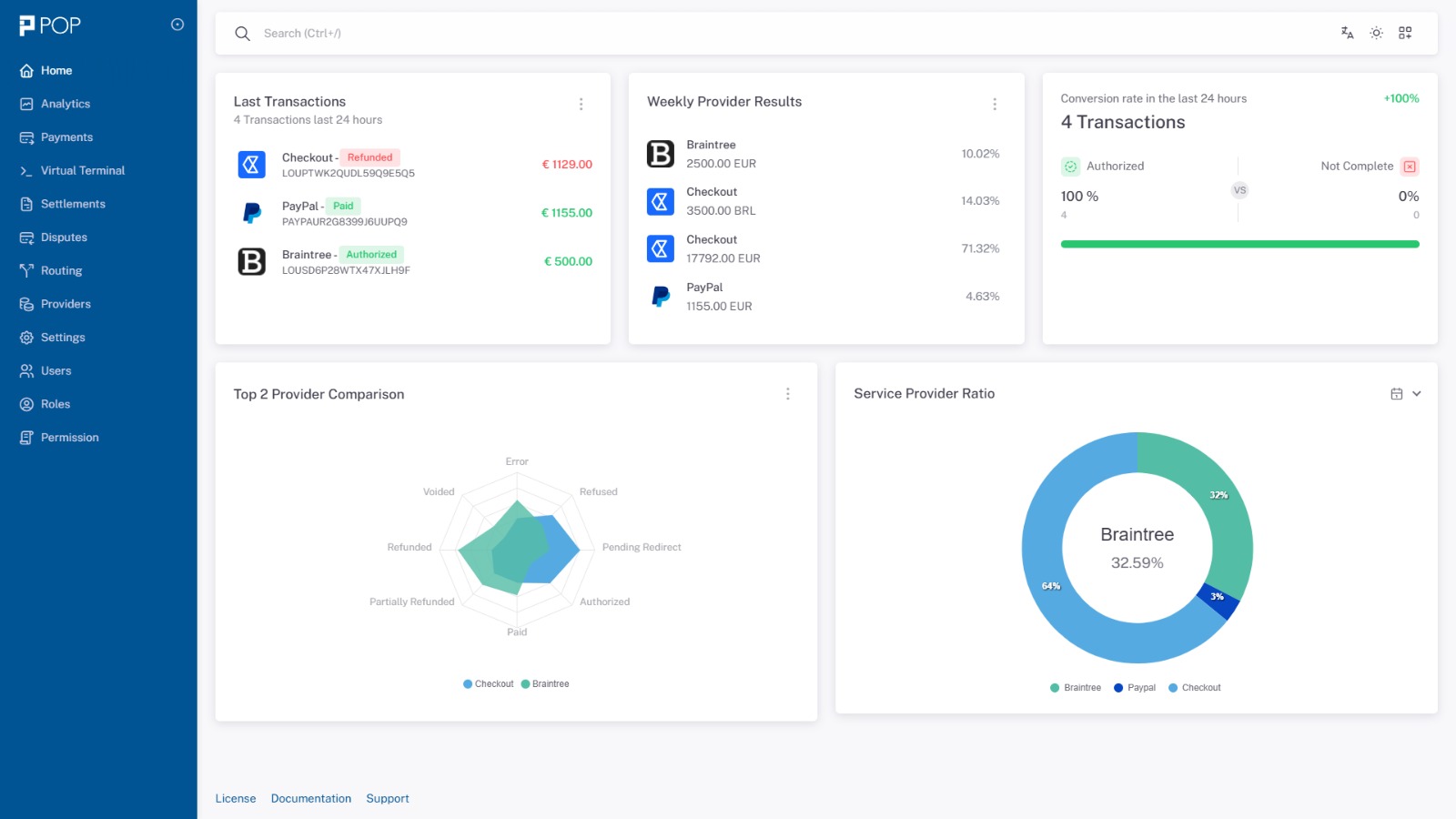

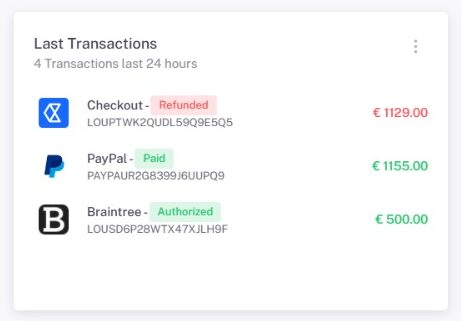

Experience swift and secure transaction processing with POP, enabling your business to move money efficiently across multiple payment providers, ensuring prompt payments and enhancing cash flow management.

Streamline your financial operations by automating the entire payment process, from initiation to reconciliation, reducing manual tasks and ensuring accuracy for a more efficient business workflow.

Effortlessly integrate with popular E-commerce platforms to streamline your payment processing, enabling a faster setup and a seamless checkout experience for your customers.

Facilitate smooth online transactions with a variety of payment options, ensuring your customers can pay easily and securely, boosting conversion rates and satisfaction.

Protect your business and customers with advanced security measures that safeguard sensitive payment information, ensuring compliance and peace of mind during every transaction.

Leverage direct integrations with leading payment providers to accelerate transaction processing, ensuring your business can transfer funds quickly and efficiently while minimizing delays and maximizing cash flow.

Enable seamless payment processing directly through your platform, ensuring quick and reliable transactions that enhance user experience and operational efficiency.

Utilize advanced anomaly detection algorithms to identify unusual transaction patterns in real time, helping to mitigate fraud risks and ensuring secure payment processing.

Simplify billing with automated recurring payments, allowing for consistent cash flow and improving customer retention through hassle-free subscription management.

Empower your business with customizable payment controls, allowing you to set limits, manage payment methods, and tailor transaction settings to fit your unique operational needs.

Streamline your accounting processes with automatic reconciliation, ensuring that payments are accurately matched and recorded, reducing manual effort and minimizing discrepancies for a more efficient financial workflow.

Find answers to common questions about POP’s platform, features, and services. Learn how we can streamline your payment operations and address your specific business needs.

POP is a centralized platform that integrates and manages multiple payment gateways, enabling businesses to streamline their payment operations, improve transaction success rates, and enhance customer experience.

POP allows you to integrate and manage multiple payment gateways from one platform, automatically routing transactions to the most efficient provider based on real-time data and predefined rules.

Yes, POP supports automated recurring payments, making it easy for businesses to manage subscription-based billing and retain customers with minimal manual effort.

POP is ideal for E-commerce, iGaming, subscription services, marketplaces, and any business that processes high volumes of payments or needs to handle multiple payment providers efficiently.

POP prioritizes security with advanced fraud detection, tokenization, and full compliance with local and global payment regulations, ensuring secure and compliant transactions.

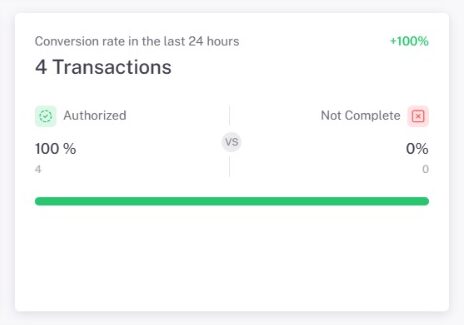

Yes, POP offers detailed analytics and reporting, allowing you to track payment performance, identify trends, and optimize your payment processes.

POP uses smart routing and automated retry logic to minimize payment failures by routing transactions to alternative gateways when necessary.

Yes, POP is designed to handle both local and international payments, allowing businesses to scale globally and accept multiple currencies.

With seamless provider integrations, smart routing, and real-time analytics, our platform optimizes transactions for efficiency, security, and cost-effectiveness. Experience smoother, more streamlined payment management tailored to your business.

Reach out for inquiries, support, or feedback, and our team will assist you promptly.

© POP 2024. All rights reserved.